Asset Allocation Strategies

March 4, 2016 - mediadealer - Money Hacks - 2,491 views

Asset allocation can be an active process to varying degrees or strictly passive in nature. Whether an investor chooses a precise asset allocation strategy or a combination of different strategies depends on that investor’s goals, age, market expectations and risk tolerance.

Asset allocation can be an active process to varying degrees or strictly passive in nature. Whether an investor chooses a precise asset allocation strategy or a combination of different strategies depends on that investor’s goals, age, market expectations and risk tolerance.

Simply stated, asset allocation is investing your money in different categories of assets—typically stocks, bonds and cash equivalents such as money market funds—so your investments are well diversified.

Invest Confidently With Asset Allocation Strategies (PDF)

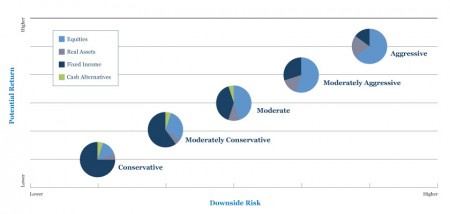

** These allocations are presented only as options and are not intended as investment advice. The investment mix that is appropriate for you depends on your age, investment horizon, goals and attitude about risk. Please consult Ascendant if you have questions about these options and how they relate to your own financial situation.

The percentage allocations shown above are target allocations as of 4th quarter 2011 as an example. These target allocations, and the actual percentage allocations to each asset class, are subject to change at any time. In addition, the underlying funds included in a portfolio the may change. **

Other articles similar to: Asset Allocation Strategies

Affiliate links EXPLAINED (QR Codes Are a Must See!)

Affiliate links EXPLAINED (QR Codes Are a Must See!) 🔥 Apply To Work With My Team 👉 https://johncrestani.com/GOAT ....

Before You Get A Payday Loan, Read This Article

Everyone has an experience that comes unexpected, such as having to do emergency car maintenance, or pay for urgent doctor's visit....

Want A Comprehensive Article On Debt Consolidation? This Is It

What kinds of things go into getting debt consolidation? Where might I find information about it that is easy to understand? What ....