Asset Allocation Strategies

March 4, 2016 - mediadealer - Money Hacks - 3,981 views

Asset allocation can be an active process to varying degrees or strictly passive in nature. Whether an investor chooses a precise asset allocation strategy or a combination of different strategies depends on that investor’s goals, age, market expectations and risk tolerance.

Asset allocation can be an active process to varying degrees or strictly passive in nature. Whether an investor chooses a precise asset allocation strategy or a combination of different strategies depends on that investor’s goals, age, market expectations and risk tolerance.

Simply stated, asset allocation is investing your money in different categories of assets—typically stocks, bonds and cash equivalents such as money market funds—so your investments are well diversified.

Invest Confidently With Asset Allocation Strategies (PDF)

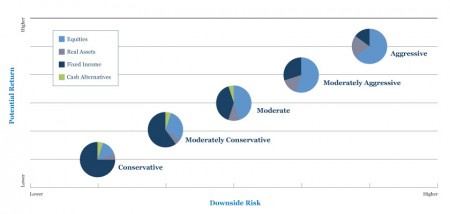

** These allocations are presented only as options and are not intended as investment advice. The investment mix that is appropriate for you depends on your age, investment horizon, goals and attitude about risk. Please consult Ascendant if you have questions about these options and how they relate to your own financial situation.

The percentage allocations shown above are target allocations as of 4th quarter 2011 as an example. These target allocations, and the actual percentage allocations to each asset class, are subject to change at any time. In addition, the underlying funds included in a portfolio the may change. **

Other articles similar to: Asset Allocation Strategies

Tips To Help You Understand How To Get Through A Personal Bankruptcy

When a person needs to file for personal bankruptcy, it is not ever a happy moment. Bankruptcy can mean bad things and it is usual....

Easy Ways To Raise Your Credit Score

You might have gotten sucked in by Capital One's pre-approved credit offers, or maybe you got into some medical debt. In any of th....

Solid Credit Card Advice For Everyone

It is possible for charge cards to assist people throughout the world in attaining their lifestyle goals. Having a credit card wil....