The Best Tips You Will Read About Home Mortgages

September 20, 2020 - mediadealer - Keeping Money - 3,081 views

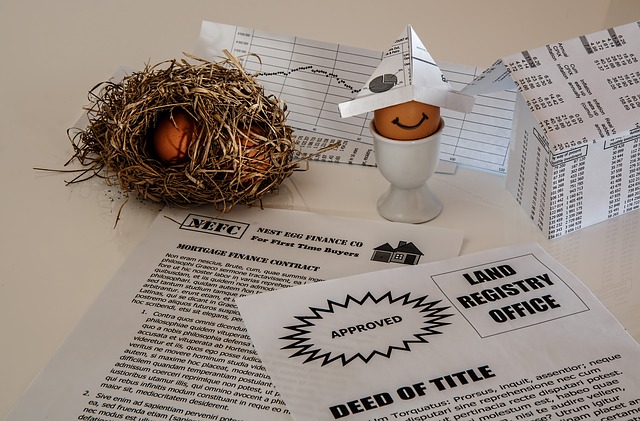

Obtaining a mortgage is a necessary step in purchasing a home. Although it can get complicated if you are unsure of how the process works. Learn about home mortgages before ever applying for a loan. You will be glad you did.

Be certain you have impeccable credit before you decide to apply for a mortgage. All reputable lenders will view your credit history with careful consideration, as it gives them a picture of their potential risk. If you have bad credit, do whatever you can to repair it to avoid having your loan application denied.

If you are buying a home for the first time, look into different programs for first time home buyers. They have programs that offer help to those with bad credit, and they can often help negotiate a more favorable interest rate.

Try to get a low rate. Keep in mind that the bank would love to have you commit to the highest rate possible. Do not allow yourself to fall victim to these lending practices. Shop around to find the best interest rate available.

Find out what type of home mortgage you need. There are several different sorts of home loans. Understanding their differences makes it simpler to figure out what you really need. Ask your lender about the various options in home mortgages.

Maximum Amount

Research your lender before signing a loan contract. Never take what a lender says on faith. Ask family and friends if they are aware of them. Look online. Check with the BBB as well. Go into any loan armed with the maximum amount of information you can find to save the maximum amount of money you can.

After you’ve successfully gotten a mortgage on your home, you should work on paying a little more than you should monthly. This will help you get the loan paid off quicker. For instance, you can decrease your loan’s term by about ten years just by paying 100 dollars more each month.

Consider using other resources other than the typical bank when it comes to searching for a mortgage. For instance, you may wish to go to family for things like your down payment. Credit unions can sometimes offer better interest rates than traditional lenders. Be sure to consider all of your options when shopping for a mortgage.

Credit Score

A good credit score is a must for a beneficial home loan. Know your credit score. Correct errors in the report, and try improving the rating. Try consolidating small debts so you can pay them off more quickly and hopefully, at a lower interest rate.

Interest rates on mortgages are important to consider, but they are not the only thing to consider. There are a lot of fees that can additionally be charged to you depending on the person you’re getting the loan from. Do not forget to include closing costs, any points and even the particular type of loan that is being offered. Shop around and compare several different estimates from mortgage lenders.

Think about getting a mortgage that lets you pay every 2 weeks. Because of how the calendar falls, you end up making two payments extra each year, which reduces your loan balance more quickly. It is a great idea to have payments automatically taken from your account.

When your loan receives approval, you might have the temptation to be a little lax. But, never do anything that might alter your individual credit score until after the loan is formally closed. The lender will likely check your credit score even after they approved the loan. If they don’t like what they see, the loan can be cancelled.

You may need to find alternative lenders to get your mortgage approved if you have bad credit. Keep payment records for up to a year. If you have thin credit, you will have to prove you have been paying utilities and rent on time.

If one lender denies you, you can simply go to the next one. Keep all of your paperwork in order. Some lenders are pickier than others, so it probably isn’t your fault. You may find the next lender sees your file as perfectly fine.

Owning a home is the American dream. But, the road to home ownership often comes with obtaining a mortgage. Don’t let your lack of knowledge keep you from taking out a home mortgage. Utilize the information you have gained from this article and you’re likely to be a step ahead of all others when taking out your mortgage.

Tags: bad credit, credit score, interest rates, maximum amount

Other articles similar to: The Best Tips You Will Read About Home Mortgages

Selling Your Home And Making A Profit

You will encounter many challenges in the process of selling your home. Proceeding with confidence is important, so arm yourself w....

Buying A New Car? Find Out About Insurance First

Car insurance terms contain a lot of wording that can be confusing. It can really seem hard to understand. Read on to learn what t....

Learn About The Important Tips Of Auto Insurance

Many people believe it is difficult to learn about auto insurance. The truth is that the more you know the less confusing it becom....

Helpful Hints To Ensure Retirement Goes Smoothly

The best way to plan for your retirement is to sit down now and start planning and funding it. Your retirement may be years or eve....

You must be logged in to post a comment.